UPDATED FEBRUARY 20, 2025

Beginning January 1, 2024, most small corporations, LLCs and certain partnerships must make ongoing and timely filings to FinCEN disclosing information about the owners and managers of the business entity. Failure to file completely and truthfully in a timely manner can result in very heavy civil and criminal penalties. Managers and owners alike will need to ensure that updated reports are filed whenever triggering events occur.

Effective January 1, 2024, The Corporate Transparency Act (CTA) imposes significant reporting requirements on businesses, their owners, and their managers. The CTA’s goal is to help combat money laundering, tax fraud and other illegal activities that have traditionally been obscured through the use of business entities by requiring entities to disclose detailed information to the Financial Crimes Enforcement Network (FinCEN).

The CTA requires that Beneficiary Ownership Information (BOI) be filed upon formation/registration of certain companies (a “Reporting Company”) and subsequent filings whenever that company’s BOI information changes. The tight timeframe and stiff penalties mean the CTA is something to pay attention to so as to remain in compliance.

- When Do BOI Filing Requirements Commence?

- When Are Initial BOI Filings Due?

- What is a “Reporting Company”?

- What Businesses Are Exempt From BOI Filing Requirements?

- What Information Is Reported On BOI Filings?

- What Information Is Required For Each Individual

- Subsequent BOI Reports

- Use of FinCEN Identifiers

- CTA Penalties and Fines

- Key Considerations

- Further CTA Resources

- For More Information And Assistance With Filing

While the CTA was passed in 2021, filing requirements began January 1, 2024. There is no filing fee for BOI reporting.

The initial BOI filing date depends on the formation date of the Reporting Company and whether it is a domestic business or foreign business:

| Formation/Registration Date* | Extended Initial Filing Deadline |

|---|---|

| Prior to February 21, 2025 | March 21, 2025 |

| On or after February 21, 2025 | 30 calendar days from formation/registration date* |

*For a domestic entity, the date of formation is the first date of (a) actual notice of formation (e.g. the Secretary of State informs the organizer the business is formed) or (b) public notice of formation (e.g. the entity shows as formed on a Secretary of State website).

*For a foreign entity, the date of registration is the first date of (a) actual notice of registration to do business in a US jurisdiction (e.g. the Secretary of State informs the organizer the business is registered) or (b) public notice of registration to do business in a US jurisdiction (e.g. the entity shows as registered on a Secretary of State website).

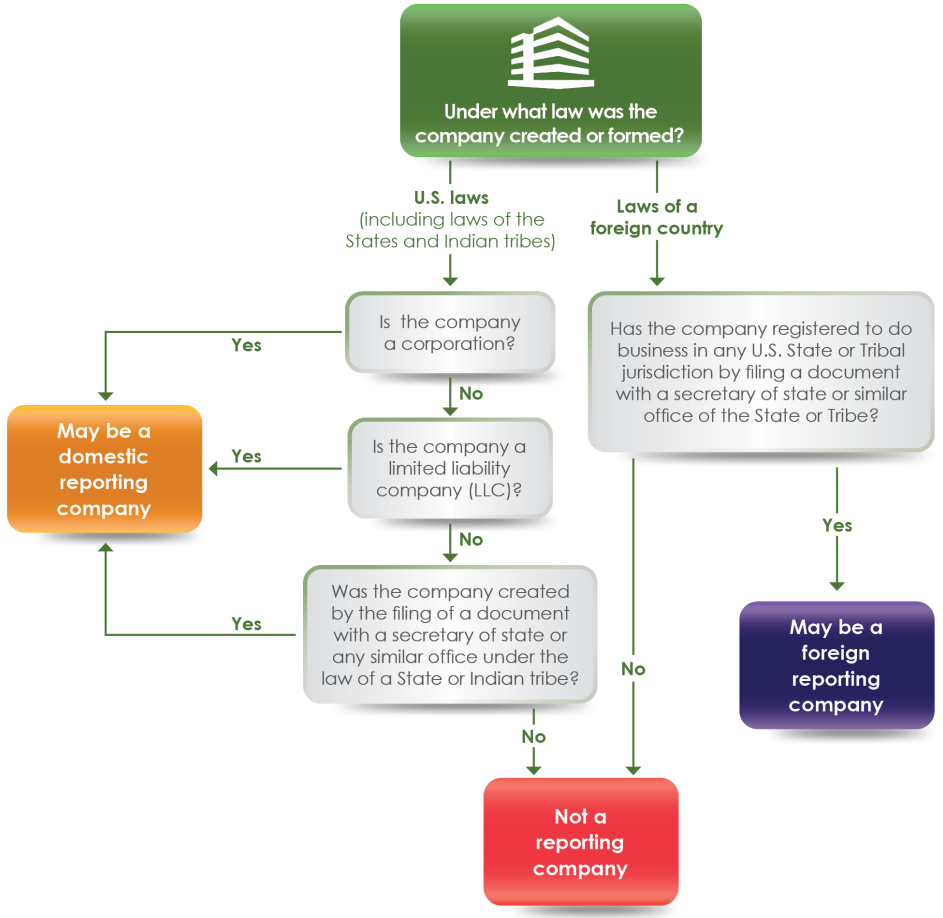

A “Reporting Company” is either:

- A domestic corporation, limited liability company, or other entity that is formed by filing with a Secretary of State or similar office, unless it is an exempt entity; or

- A foreign corporation, limited liability company, or other entity that is formed outside the United States but registered to do business in the United States by filing with a Secretary of State or similar office, unless it is an exempt entity.

Domestic sole proprietorships, general partnerships not registered with a Secretary of State, joint ventures not registered with a Secretary of State, unincorporated associations, common law trusts and foreign businesses not registered to do business in the United States would not be considered Reporting Companies.

Source: FinCEN Small Entity Compliance Guide (https://www.fincen.gov/sites/default/files/shared/BOI_Small_Compliance_Guide.v1.1-FINAL.pdf)

The CTA provides for 23 categories of exempt entities that are not required to make BOI filings. Many of these exemptions are for businesses that are already in regulated industries such as public utilities, banks, credit unions, insurance companies, securities brokers, etc. that are already subject to government oversight, such as tax-exempt entities.

The full list of exemptions can be found https://www.fincen.gov/boi-faqs#L_1. Subsidiaries “controlled” by exempt entities are also exempt. While neither the CTA nor the pertinent Treasury Regulations clarify “control” in this context, the prevailing assumption is that “control” in this context means greater than 50% voting control of the subsidiary.

Of particular note among the exemptions is the exemption for a “large operating company,” which is a business entity that meets six criteria that can be summarized as follows:

- The entity has more than 20 full-time employees employed in the United States.

- The entity has a physical office within the United States.

- The entity filed federal income tax showing more than $5 Million indomestic gross receipts for the previous year on an IRS Form.

A Reporting Company filing a BOI submission must include the following information:

Reporting Company Information

- Legal name and trade names (DBAs) of the Reporting Company.

- Reporting Company’s principal US physical address.

- Reporting Company’s Taxpayer Identification Number.

Company Applicant Information

For a domestic Reporting Company formed on or after January 1, 2024, or a foreign Reporting Company registered to do business in the United States on or after January 1, 2024, the “Company Applicants” must be reported.

The Company Applicants are a minimum of one and maximum of two individuals who directly or indirectly filed to create or register the business. A direct filer would be the individual who physically or electronically filed the document with the Secretary of State that formed the domestic business entity or registered the foreign business entity. An indirect filer would be an individual who was primarily responsible for directing or controlling the creation of the formation/registration document but who did not actually file the document itself. In the context of a law firm forming an LLC for a client, for example, the direct filer might be a paralegal who submits the formation documents to the Secretary of State and the indirect filer may be the attorney overseeing the process and instructing the paralegal to file. Both the paralegal and attorney in this example would be Company Applicants.

Source: FinCEN Small Entity Compliance Guide (https://www.fincen.gov/sites/default/files/shared/BOI_Small_Compliance_Guide.v1.1-FINAL.pdf)

Beneficial Ownership Information

Each “Beneficial Owner” of the Reporting Company needs to be reported on the BOI filing. For purposes of the BOI filings, a “Beneficial Owner” is an individual who either (a) exercises “substantial control” over the Reporting Company or (b) owns or controls, either directly or indirectly, 25% or more of the “ownership interests” of the Reporting Company.

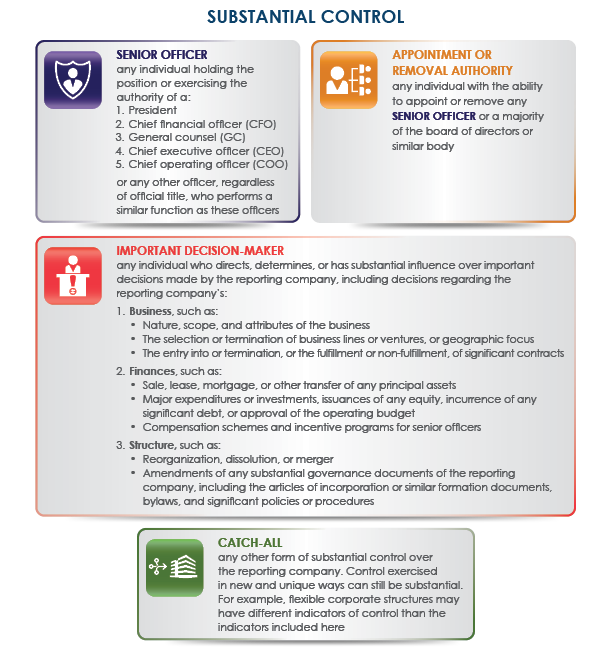

Those having “substantial control” over a Reporting Company is any individual who (a) is a senior officer, (b) has authority to appoint or remove certain officers or a majority of directors, (c) is an important decision-maker, or (d) has any other form of substantial control over the company. This would include C-level executives, directors or very senior executives with significant influence over important decisions. Substantial control also includes the manager of an LLC, general partner of a partnership, Trustee of a trust and similar managerial roles.

Source: FinCEN Small Entity Compliance Guide (https://www.fincen.gov/sites/default/files/shared/BOI_Small_Compliance_Guide.v1.1-FINAL.pdf)

“Ownership interest” in a Reporting Company means any equity, stock, voting rights, capital or profits interest, convertible instrument, options or other non-binding privileges to buy or sell interests and any other similar interest in a Reporting Company. For purposes of a trust, an ownership interest is considered to be held by all of (1) the Trustee(s), (2) a beneficiary who is the sole permissible recipient of income and principal or who has the right to demand distribution or withdrawal substantially all of the trust assets, and (c) the grantor(s)/settlor(s) who have the right to revoke or otherwise withdraw trust assets.

Source: FinCEN Small Entity Compliance Guide (https://www.fincen.gov/sites/default/files/shared/BOI_Small_Compliance_Guide.v1.1-FINAL.pdf)

While the statutes, pertinent Treasury Regulations, FAQs and related materials put out by FinCEN do not directly address community property interests, the spirit of the rules suggests that any community property ownership interest, even if nominally held in only one spouse’s name, should be listed with both spouses having an ownership interest.

The definition of Beneficial Owners also includes several exceptions, including:

- Minor children (in which case the parent or legal guardian should be listed);

- A nominee, intermediary, custodian or agent merely acting on behalf of another (in which case the actual owner should be listed);

- An employee of a Reporting Company whose substantial control over, or economic benefit from, a Reporting Company is derived solely from being an employee (i.e. not also a shareholder) and who is not a “senior officer” of the company.

- An individual with only a future interest in the company (e.g. one who expects to inherit it in the future).

- A creditor of the Reporting Company who would only meet the definition of a Beneficial Owner by reason of fixed loan to, or debt incurred by, a Reporting Company.

Beneficial Owners also includes those with indirect beneficial ownership of a Reporting Company. The rules look through parent companies to the parent company’s beneficial owners. As an example, suppose Reporting Company Corporation A is held 70% by LLC B and 30% by Individual 1. LLC B is held 60% by Individual 2 and 40% by Individual 3. For purposes of the BOI filing for Corporation A, the three beneficial owners are Individual 1 (30% of Corporation A held directly), Individual 2 (42% of Corporation A held indirectly through LLC B), and Individual 3 (28% of Corporation held indirectly through LLC B). In this regard, the BOI reporting rules resemble the ownership attribution rules under California’s property tax system.

Each Company Applicant and Beneficial Owner is required to disclose:

- Legal name

- Date of birth

- Current address (residential, except in the case of a Company Applicant who forms or registers companies in the course of its business, in which case a business address may be used).

- A unique identifying number from a valid (non-expired) US government or US state-issued photo identification document, or if an individual does not have a US/state-issued document, from a non-expired foreign passport.

- An image of the identification document used.

The CTA sets the deadline for a Reporting Company’s initial BOI filing, described above. While there is no annual filing requirement, a supplemental BOI must be filed within 30 days of any change in information or discovery of an error in previously reported information. This suggests that a supplemental filing is required whenever there is a change or correction to any of the identifying information about the Reporting Company or its Beneficial Owners, including names, addresses, US/state/foreign identification numbers, and, it seems, issuance of a new US/state/foreign identification document to the individual. A supplemental filing is also required within 30 days of any change in the Beneficial Ownership of the Reporting Company, including the issuance, redemption, or transfer (including upon death) of any ownership interests.

The CTA provides for each individual and Reporting Company to optionally apply for a “FinCEN Identifier,” which is a unique identifying number issued by FinCEN upon request. Applying for a FinCEN identifier requires disclosing the same information required in the BOI filing and FinCEN identifiers are issued immediately.

Individuals with FinCEN identifiers can use that identifier on BOI filings in lieu of filling in the specific information about the individual or having to provide that information to the entity’s managers. This not only provides individuals with a measure of privacy, but it also makes the reporting less onerous for the reporting entity. While the Treasury Regulations do not directly address the issue, the consensus is that a supplemental BOI filing only needs to be made when information previously reported on a BOI filing changes. If, for example, a Beneficial Owner’s FinCEN identifier is reported on a BOI filing instead of the Beneficial Owner’s specific information, a later change in that Beneficial Owner’s address, for example, seems not to trigger a new BOI filing requirement. It would, however, require the individual to update his or her FinCEN identifier information online. The use of FinCEN identifiers thus would shift some of the burden of tracking and reporting changes to individuals rather than the entity, but entity managers should remain vigilant for any changes that may trigger reporting requirements by the entity itself.

The CTA provides for civil penalties of up to $500 for each day the violation continues and/or criminal penalties including imprisonment for up to two years and/or a fine of up to $10,000. These penalties can apply to any individual, including a senior manager of a company, where there is a willful failure to report complete or updated beneficial ownership information or the willful provision of false or fraudulent beneficial ownership information. Penalties can also apply to an individual who willfully causes a company not to file a required BOI or to report an incomplete or false beneficial ownership information. These significant potential penalties mean that all senior managers of entities, as well as those that form entities in the course of business, should very carefully work to ensure compliance with the BOI filing requirements.

FinCEN promises to store the BOI securely and the CTA only allows for disclosure of BOI information upon application to limited parties, including US local, state and federal government agencies, financial institutions with the consent of the Reporting Company, and foreign officials making requests through a US federal agency.

In light of the CTA requirements, there are several action steps to take to best ensure CTA compliance. For example:

- Applying for a FinCEN identifier for yourself online at https://fincenid.fincen.gov/landing.

- Nominating one manager of each entity to spearhead CTA compliance.

- Gathering the necessary biographical information or FinCEN identifier of each person of Beneficial Owner of an entity.

- Ensuring that governing documents of entities, trusts and employment relationships clearly define CTA reporting obligations and time limits for informing an entity of changes that may trigger updated BOI filing requirements.

Please contact Brian for questions about the BOI filing requirement or help with BOI compliance.

© 2024 Brian Berman Law, P.C. All rights reserved. This summary contains information of a general nature that is not intended to be legal advice and it does not create an attorney-client relationship between Brian Berman Law, P.C. and the reader. Each readers should consult his or her own legal counsel with respect to his or her individual circumstances and how this material may affect his or her situation. This summary may constitute attorney advertising. Prior results do not guarantee a similar outcome.